What is ACH Fraud?

ACH fraud refers to unauthorized electronic transactions that are made through the Automated Clearing House (ACH) network. This type of fraud can occur when a criminal gains access to a person’s bank account information and uses it to make unauthorized transactions, such as transferring money to another account or making online purchases. ACH fraud can also happen when a criminal creates fake checks or electronic payments using stolen account information.

What are examples of ACH Fraud?

There are several different types of ACH fraud, including:

- Account takeover: This occurs when a criminal gains access to a member’s bank account information and uses it to make unauthorized transactions.

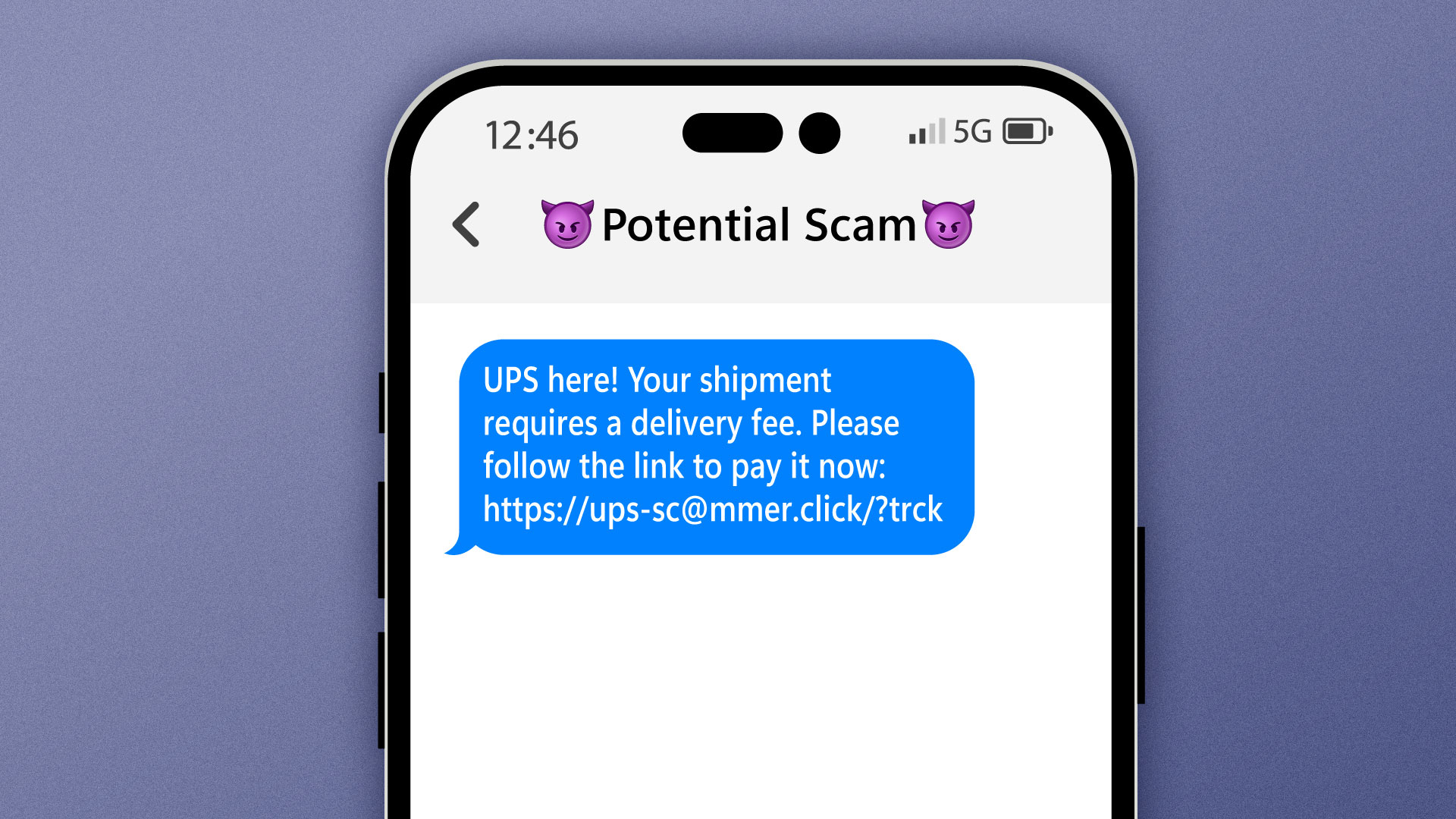

- Phishing: This is a tactic where criminals send fraudulent emails or text messages, asking for personal information such as account numbers or login credentials.

- Check fraud: This occurs when a criminal creates fake checks using stolen account information.

- Card not present fraud: This type of fraud occurs when a criminal uses stolen card information to make online purchases.

- Returned item fraud: This occurs when a criminal uses a fake or stolen check to make a purchase and then stops payment on the check, causing the funds to be withdrawn from the merchant’s account.

- ACH credit/debit fraud: This occurs when a criminal uses stolen information to create fake electronic payments, causing funds to be transferred into a fraudulent account.

These are just a few examples of the different types of ACH fraud. The best way to protect against ACH fraud is to be vigilant and to take steps to secure your personal and financial information.

How do I prevent ACH Fraud?

- Use strong, unique passwords and change them frequently.

- Use two-factor authentication for any accounts that offer it.

- Monitor your account transactions and statements regularly to look for any unauthorized transactions and report suspicious activity immediately.

- Use anti-virus and anti-malware software to protect your computer and mobile devices from cyber-attacks.

- DO NOT respond to phishing emails or text messages asking for personal financial information, and never click on links provided in these types of communications. DO NOT give out personal information or financial information to unsolicited phone callers.

What is Charter Oak doing to prevent ACH fraud?

Charter Oak is taking several steps to prevent ACH fraud:

- Implement fraud detection and monitoring systems using sophisticated software to monitor and detect suspicious activity on member accounts, such as unusual account activity or large transactions.

- Implement multi-factor authentication methods, such as a password and a one-time code sent to a member’s mobile phone, to ensure that only authorized users can access and make transactions on an account.

- Use encryption and secure communication methods to protect sensitive member information and prevent unauthorized access to account information.

- Review and monitor transactions regularly to detect any suspicious activity and take appropriate action.

- Provide our members and employees educational materials to keep them updated with fraud prevention.

What should I do if I suspect an ACH scam?

If you suspect that you have fallen victim to ACH fraud, it is important to take immediate action to protect yourself and your finances. Here are some steps you should take:

- Contact Charter Oak immediately so we can take the appropriate actions to prevent further unauthorized transactions, which may include freezing or closing your account(s).

- Change your passwords: Change the passwords for all of your online accounts, including bank accounts, email, and social media accounts. Use strong and unique passwords.

- File a police report: Contact your local police department and file a report. This will help them to investigate the fraud and may be useful in any legal proceedings that may follow.

- Monitor your credit reports: Check your credit reports from all three credit reporting agencies to ensure that there are no unauthorized accounts or charges.

Remember that you are not alone and there are resources available to help you. It may take time and effort to resolve the issue, but taking action quickly can minimize the damage and help you recover from the fraud.