Fraud Prevention Begins with Education

In this blog we’ve put together a step-by-step guide on how to set up your security settings to protect your money.

Fraud prevention begins with education on how you can protect yourself against fraudulent scams and protect your money. In 2022 there were an estimated 70 million Americans that lost money to fraud, totaling nearly $12 billion in losses.

Fraud scams are increasing in numbers and sophistication.

Educating yourself on the types of fraud and what you can do to prevent yourself from becoming a victim are the first steps in protecting your money. Below are five of the most frequent types of scams happening with financial institutions around the world.

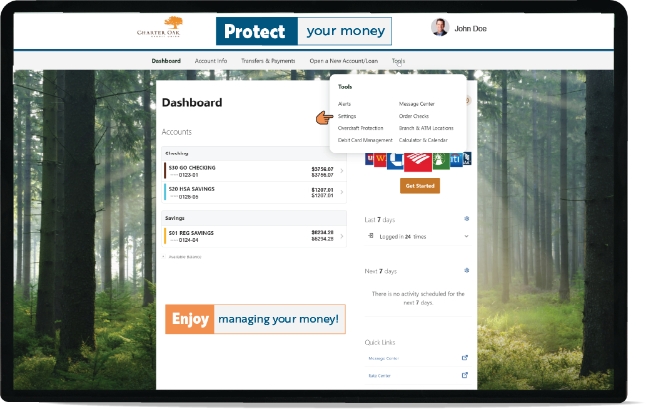

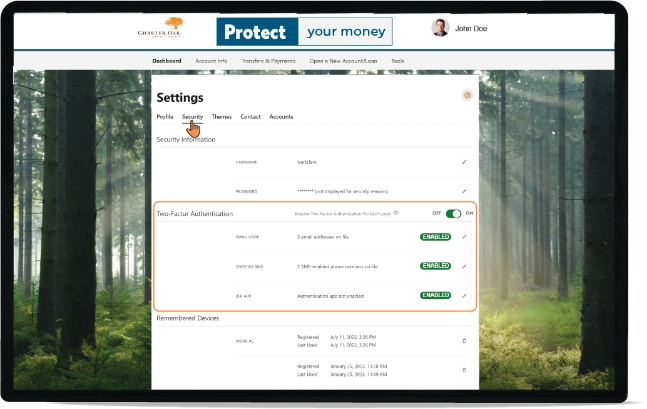

How to setup two-factor authentication.

1. Begin by logging into online-banking in a web browser on your mobile or desktop device. Log in here: Online-Banking >

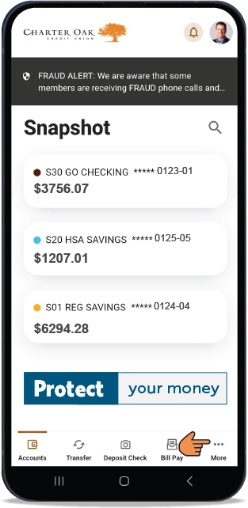

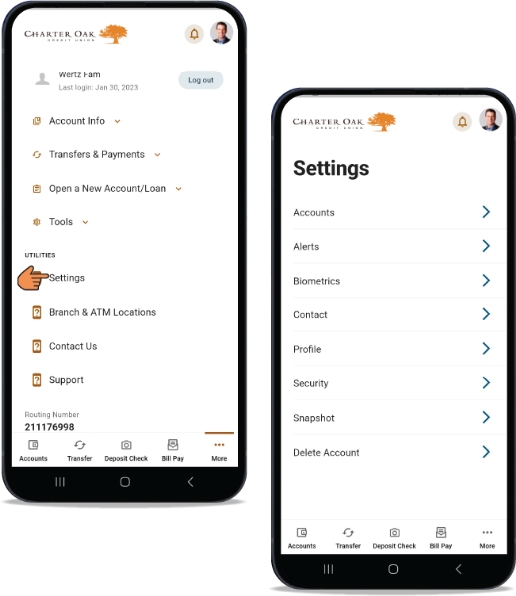

How to setup biometrics and alerts using the Charter Oak app.

Using biometrics on your mobile device ensures that your accounts cannot be accessed without a finger or facial scan. Protecting you in the case of a lost or stolen device.

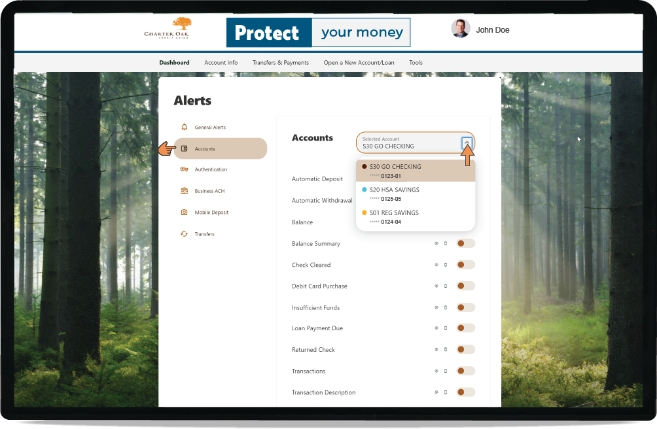

Setting up alerts on your accounts to get notifications of specific account events offers account activity in real-time.

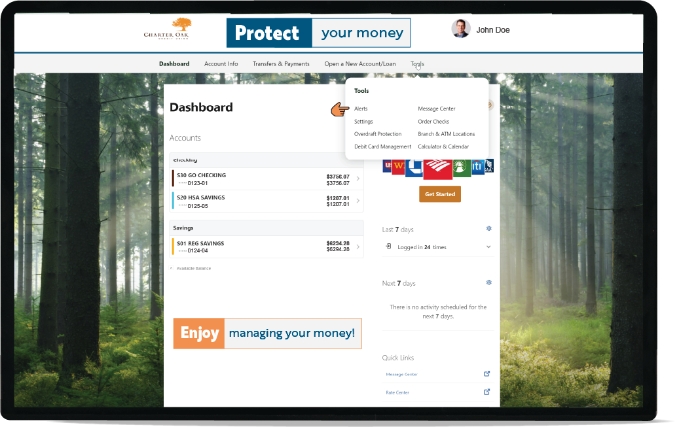

How to setup account alerts using a web browser.

1. Begin by logging into online-banking in a web browser on your mobile or desktop device. Log in here: Online-Banking >

Get Educated and protect your money!

- ACH Fraud: This type of fraud can occur when a criminal gains access to a person’s bank account information. Read More >

- Fake Website Fraud: A fake website scam, also known as phishing, is a type of fraud in which an attacker creates a replica of a legitimate website to trick users into entering personal or financial information. Read More >

- Text Message Fraud: Text message fraud refers to the use of text messaging to scam or defraud members. Read More >

- Fake Phone Calls: Phone scams are fraudulent attempts to trick members into giving away personal information or money over the phone. Read More >

- Check Fraud: Check fraud refers to the illegal use of a check or other types of financial instruments (such as electronic funds transfers or credit card transactions) with the intent to defraud or deceive. Read More >