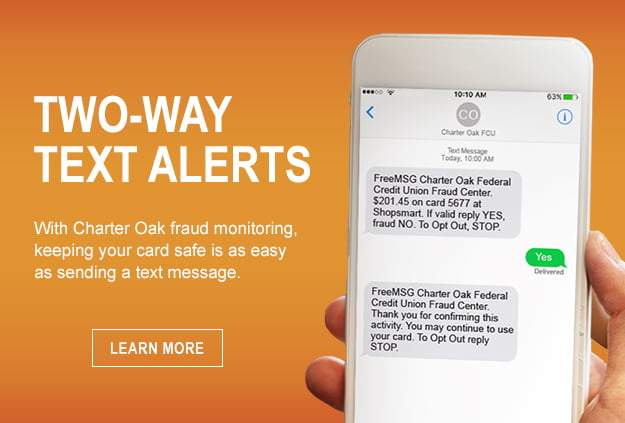

Text Message Debit Card Fraud Alerts

We want you to enjoy the convenience of our Debit Card Fraud Alerts Service! In order to do so, we will need you to update your cell phone number if you haven’t done so already. You have three easy options to update your cell phone information to enable our Debit Card Fraud Alerts Service:

- Send a secure message via Online Banking

- Call our Contact Center at 860.446.8085 or toll free 800.962.3237

- Visit us in any branch

The benefits of this Fraud Alerts Service will allow for:

- An additional layer of fraud protection

- The ability to confirm or deny a transaction with a simple text message

- A seamless and easy way to keep your Debit Card safe or keep it from being blocked

- Peace of mind knowing your transactions are being monitored by a state-of-the-art system

| Sample Text | Why text was sent |

|---|---|

| FreeMSG Charter Oak FCU Fraud Center 8772538964 $125.46 on card 1234 at Macy’s. If valid reply YES, fraud NO. To Opt Out, STOP. | Sent when fraud case is created. |

| Sample Text | Why text was sent |

|---|---|

| FreeMSG Charter Oak FCU Fraud Center 8772538964 $125.46 on card 1234 at Macy’s. If valid reply YES, fraud NO. To Opt Out, STOP. | Sent when fraud case is created. |

Mobile Deposit

With Mobile Deposit, you can deposit checks wherever you are, whenever you like, in the comfort of your own home or even on the go! It's as easy as taking a picture with your smartphone. Account must be open for a minimum of 90 days. Some restrictions apply. Must accept User Agreement prior to using.

Please note: The daily limit for our Mobile Deposit service is 10 checks or a total dollar amount of $5,000, effective March 23, 2021. The monthly limit is 20 checks or a total dollar amount of $15,000, effective March 23, 2021.

Mobile Wallet

Use your digital wallet to make purchases through Android Pay™ or Apple Pay™ in stores where you see contactless terminals - just hold your phone at the kiosk! Make payments, view your transaction history and much more, all while keeping your information safe and secure! Load your Charter Oak credit and/or debit card today!

Android Pay™ Frequently Asked Questions

Apple Pay™ Frequently Asked Questions

eDocuments

eDocuments allows Charter Oak to deliver members' statements via the Internet up to 10 days sooner than if the statements were mailed. With our improved Online Banking, you can view up to 24 months of statement history at any time and also access other information such as notices.

With eDocuments, you will also receive electronic tax forms and other important information from Charter Oak straight to your computer.

Bill Pay

This service offers an alternative to the traditional way of paying bills. You may schedule payments to be made on specific dates or on a recurring schedule. Each transaction will be clearly detailed on your monthly statement. Features:

- Make payments from multiple checking accounts including HSAs.

- Add payees.

- Pay individuals via electronic payment directly to their personal account.

- Automate recurring payments.

- View payment amounts and due dates of upcoming bills.

- View the last payments you processed and their current status in the "History" tab.

- Online Banking, Mobile Banking, Mobile Deposit and Bill Pay are provided with no monthly maintenance fee!

Info-Phone

Your accounts are at your fingertips with our free Info-Phone service. Simply call from your phone to access your accounts day and night, 7 days a week. If you're out of town, call our toll-free number.

Info-Phone gives you up to the minute account information. Easy step-by-step instructions walk you through each call.

With Info-Phone you can:

- Make account balance or history inquiries

- Transfer funds within your accounts

- Make loan payments

- Obtain loan advances

- Verify if a check has cleared

- And more

Access Info-Phone by calling: 860.445.INFO (4636) or 800.446.3228

Browser Requirements

- Internet access through an ISP provider

- Firefox+

- Microsoft Edge+

- Safari+

- Google Chrome+

- Secure Sockets Layer (SSL) support

- 128 bit encryption

+ We will support the last two versions of Microsoft Edge, Firefox, Safari and Chrome. Utilizing older browsers may result in disabled functionality or limited access to services. The supported browsers above are for use with the traditional online banking interface and devices (desktop/laptop), and do not apply to use with mobile devices (phones/tablets). If using a phone or tablet to access online banking outside of an app, functionality and appearance may vary from the traditional interface.